Google's Rumored Investment in Anthropic: i10x Analysis

Google-Anthropic Rumored Investment: i10x Analysis

⚡ Quick Take

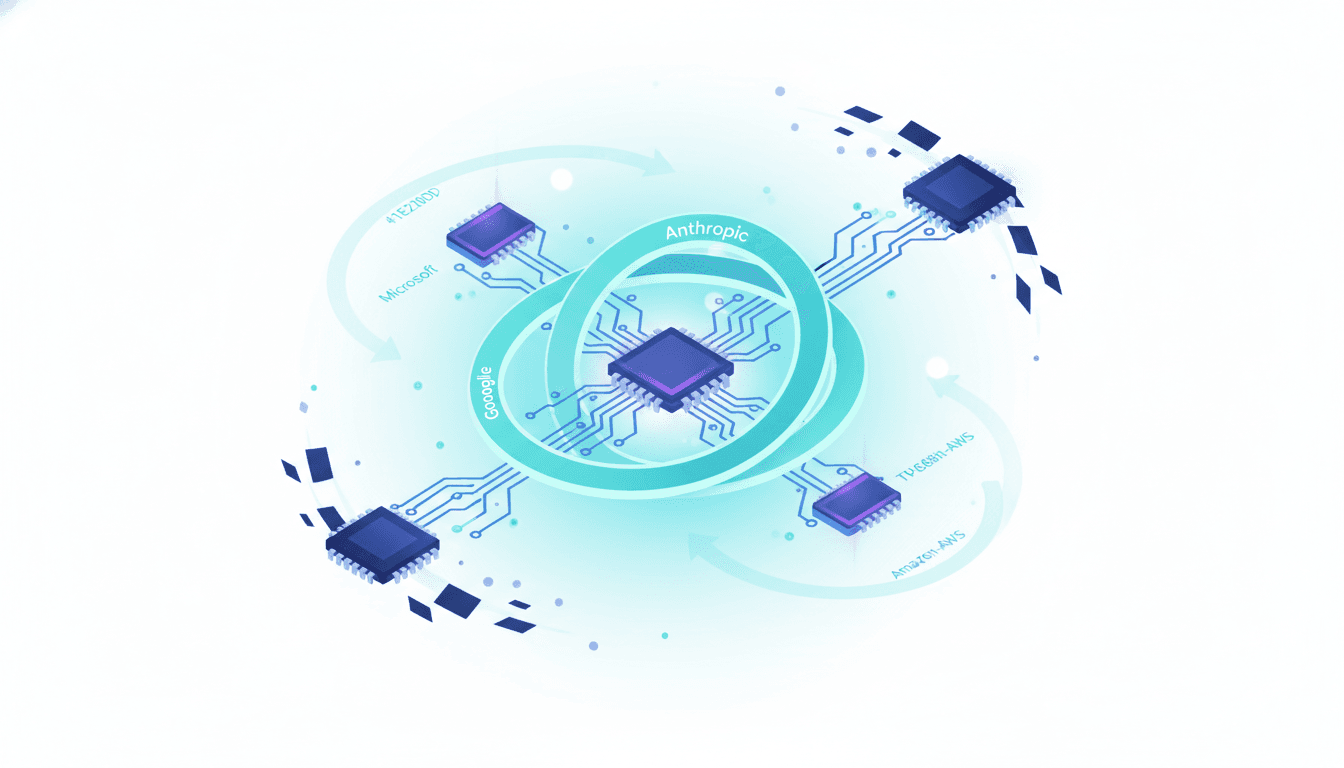

Imagine a rumored multi-billion dollar follow-on investment from Google into Anthropic - it's not just about throwing money around, but a calculated play in the intense proxy battles among hyperscalers to win over AI compute resources. With a potential valuation pushing past $350 billion, it really makes you wonder: is this a straightforward wager on Anthropic's Claude models, or Google shelling out big to tie a major AI player to its TPU setup and sidestep the Microsoft-OpenAI-Nvidia powerhouse?

Summary: From what I've gathered in a Business Insider report, Google is kicking off early talks to ramp up its investment in AI competitor Anthropic. Though it's all unverified for now, the buzz points to a fresh funding round that could peg the AI safety outfit at a staggering $350 billion or higher - ramping up the money and strategy showdown in generative AI.

What happened: Google, holding about a 14% stake and already over $3 billion in the pot, is apparently eyeing another hefty cash infusion. This fits right into the string of enormous, tangled deals lighting up the AI world, like Amazon's $4 billion pledge to Anthropic or Microsoft's multi-billion ties with OpenAI.

Why it matters now: Here's the thing - this step hints at the "hyperscaler-as-patron" approach picking up speed. Google isn't merely backing a model builder; it's nailing down a prime user for its tailored AI chips (those TPUs) and Google Cloud. It builds a solid pushback against Microsoft's tight knit with OpenAI. And if that valuation holds water, it marks a wild new standard for the price tag on steering a top-tier AI lab.

Who is most affected: At the heart, it's Anthropic facing a test of its independence; Google doubling down on a partner that's not fully locked in; and rivals like Amazon and the Microsoft-OpenAI crew, who'll have to rethink their game plans. Even enterprise folks feel the ripples, since these pacts influence the staying power, costs, and backbone tech of the AI tools they rely on day to day.

The under-reported angle: Coverage tends to zero in on that flashy valuation number. But the deeper tale lies in how the deal ticks - probably blending cash, convertible debt, and huge chunks of cloud credits. This goes beyond your typical venture bet; it's more like a intricate union of funds and firepower, aimed at locking in loyalty for AI tasks and boosting Google's own TPU gear in a field where Nvidia's GPUs still rule the roost.

🧠 Deep Dive

Have you ever sensed how a single rumor in tech can ripple out to reshape entire industries? These whispers about Google amping up its stake in Anthropic feel less like breaking news and more like an early rumble of big changes in AI's foundational layers. Sure, the press is buzzing over that unconfirmed $350 billion-plus valuation, but the real story - the strategic thinking fueling it - carries way more weight. It's not solely about bankrolling Anthropic's upcoming Claude iterations; it's Google's bid to stay in the game and grab some real sway in this AI-driven world.

That said, one key detail often slips by in the headlines: the line between a simple stock buy-in and what amounts to a partnership in disguise. These blockbuster arrangements usually weave in tricky tools like convertible notes, and - importantly - big waves of cloud credits. It works out nicely for everyone involved: Anthropic taps into virtually endless computing power needed to train those cutting-edge models, while Google lands a steady, heavy-hitting client for its cloud services and, even better, its in-house Tensor Processing Units (TPUs). Tying Anthropic to the TPU world like this? It forges a strong, end-to-end rival to the mighty Microsoft-OpenAI-Nvidia bloc.

This whole "compute-for-influence" play sits at the heart of today's AI standoff, almost like a new cold war. AI advances keep hitting walls thanks to limited compute, so the big cloud players are wielding their data centers as their sharpest tools. A tighter Google-Anthropic link would strike right at Nvidia's stronghold, proving TPUs can handle the heavy lifting for massive training and running models. For Anthropic, though, it's a bit of a double-edged deal - plenty of resources to go toe-to-toe with OpenAI, but at the cost of some freedom, leaning too hard on one provider even while juggling ties to Amazon Web Services.

And let's not overlook how this spotlights governance issues. Even minority investments without voting rights can tug hard at a company's direction and business choices. As the boundaries between cloud giants and their backed AI outfits grow fuzzier, regulators are paying close attention. These strengthening bonds are bound to draw antitrust heat, with officials probing if they box out competition by building walled-off AI realms that cramp options for builders and businesses alike. Whatever comes from these negotiations, it'll shape not only Anthropic's path but the whole layout of AI rivalry for years ahead - something worth keeping an eye on.

📊 Stakeholders & Impact

Stakeholder / Aspect | Impact | Insight |

|---|---|---|

Anthropic | High | It locks in huge funding and raw compute power for pushing ahead with models like Claude 4, but that closeness to Google might strain ties with others, say Amazon - a trade-off that's hard to ignore. |

Google / Google Cloud | High | If it goes through, this would hook a marquee AI project to Google Cloud and those TPU speedsters, spinning up a fresh story against the iron grip of Microsoft-OpenAI-Nvidia, much like challenging an old tech dynasty. |

Amazon (AWS) | Significant | Being a key backer and cloud ally already, Amazon finds its spot trickier now. They'll likely need to step up their game or risk getting pushed to the edges in Anthropic's world. |

Microsoft & OpenAI | Medium | The pressure dials up in the race, but it also nods to their partnership blueprint. It drives home that tying into a hyperscaler isn't optional anymore for labs chasing the frontier. |

Regulators | Medium-High | Antitrust worries spike over AI clout pooling in just a handful of giants. Deals heavy on cloud credits? Expect global watchdogs to dig deeper into whether they lock down the field too tightly. |

✍️ About the analysis

I've put together this independent i10x breakdown drawing from public reports on the news, a feel for how cloud markets operate, and patterns we've seen in AI funding rounds. It's geared toward tech planners, business heads, and coders navigating where money, hardware, and rivalry collide in the AI space - the kind of insights that help make sense of it all.

🔭 i10x Perspective

From what I've observed, the days of standalone, VC-backed AI labs might be winding down. Building those frontier models calls for cash and compute on a scale only hyperscalers can match these days. It shifts AI outfits from standalone research shops to vital pieces in a larger push for AI leadership - one waged through chips, clouds, and those eye-popping contracts.

The big puzzle now? It's shifted from "who's got the smartest model" to "who holds the reins on the systems that build and run it." As these links solidify, we could see the AI scene splitting into a few locked-in worlds, where the real defenses come from server farms, bespoke hardware, and commitments worth billions in pre-paid compute. Anthropic isn't simply getting a check; it's getting pulled into the fray.

Ähnliche Nachrichten

Google's AI Strategy: Infrastructure and Equity Investments

Explore Google's dual-track AI approach, investing €5.5B in German data centers and equity stakes in firms like Anthropic. Secure infrastructure and cloud dominance in the AI race. Discover how this counters Microsoft and shapes the future.

AI Billionaire Flywheel: Redefining Wealth in AI

Explore the rise of the AI Billionaire Flywheel, where foundation model labs like Anthropic and OpenAI create self-made billionaires through massive valuations and equity. Uncover the structural shifts in AI wealth creation and their broad implications for talent and society. Dive into the analysis.

Nvidia Groq Deal: Licensing & Acqui-Hire Explained

Unpack the Nvidia-Groq partnership: a strategic licensing agreement and talent acquisition that neutralizes competition in AI inference without a full buyout. Explore implications for developers, startups, and the industry. Discover the real strategy behind the headlines.